Many life insurance companies. June 24 2021.

Surrender A Universal Life Insurance Policy Wealth Management

If you have questions.

. They told her she can surrender her life insurance policy and receive 11321 cash. Average 4X cash surrender value. When replacing or exchanging one cash value life insurance policy for another it is possible to defer any taxable gain resulting from the surrender of the original policy.

Selling a whole life insurance policy in a life settlement is a strategy to get far greater returns than a surrender. Ad Discover life settlements. Ad Discover life settlements.

Speak with an expert today. Keep in mind. Ad Cover medical expenses fund retirement pay down debt travel.

How much money you get for it will depend on the amount of cash value held in it. Yes you can. September 18 2021.

For example if a person has a permanent life insurance policy with a death. The cash surrender value also known as the cash value is the amount of money left over after fees are deducted. Other names include the surrender cash value or in.

Sell your life insurance for cash. If you miss a premium payment and dont pay it within the grace period the 30 to 31 days after your due date during which you still have coverage your insurance is canceled. Sell your life insurance for cash.

The policy is intangible and pays a. The insurance company can only hold your cash surrender value for a set period that is determined by law before they have to give it to you. Amanda Shih is an editor.

Dont lapse or cancel. Maximize your cash settlement. A surrender charge is a fee levied on a life insurance policyholder upon cancellation of his or her life insurance policy.

On averageevery 100000 in life insurance policy value will only gain back 460. If you surrender a cash value life insurance policy any gain on the policy over and above your cost basis premiums paid will be subject to federal and possibly state income tax. This means upon death theres no payment to your beneficiaries.

You can cancel a whole life insurance policy but you usually pay a penalty and lose out on cash surrender value if you cancel in the first 10 years. You buy the policy with a term ranging anywhere from 5 years to 35 years. All policy types qualify.

Stop making the premium payments. Get the info you need. What Is The Cash Surrender Value Of A Life Insurance Policy.

Speak with an expert today. Call your insurance company and tell them you would like to surrender your life insurance policy for cash value. The surrender charge is supposed to.

The payment youll receive with a cash surrender of your life insurance is the cash value of that policy minus. The fee is used to cover the. A life insurance policy issued on or after June 21 1988footnote 1may be classified as a modified endowment contract MEC if the cumulative premiums paid during.

The surrender value is the actual sum of money a policyholder will receive if they try to access the cash value of a policy. All policy types qualify. It is not possible to cash out life insurance for the full amount of the death benefit.

Get the info you need. The insurance company sent her a Cost basis amount of 16528 with a 0 taxable gain. If you have say 10000 of accumulated cash.

During the life of your plan roughly one-third of your premiums go. Dont lapse or cancel. You can cash out a life insurance policy.

When you cancel whole life insurance you gain the full amount of your investment minus fees. Ad Cover medical expenses fund retirement pay down debt travel. For a policy that has a stated cash surrender value from the insurance agency as part of the policy.

Taxes on surrendering life insurance cash surrender life insurance policy life insurance cash surrender meaning life insurance surrender tax consequences life insurance policy surrender. A surrender charge is a fee -- a cost that the insurance company imposes for the cancellation of a policy or for reducing the face amount of life insurance. So although your cash.

Almost all policies have a surrender charge which can be as high as 35 or more depending on the elapsed period of time since the policy was taken out. You are allowed to surrender your policy. This taxable amount reflects the investment gains that you took out.

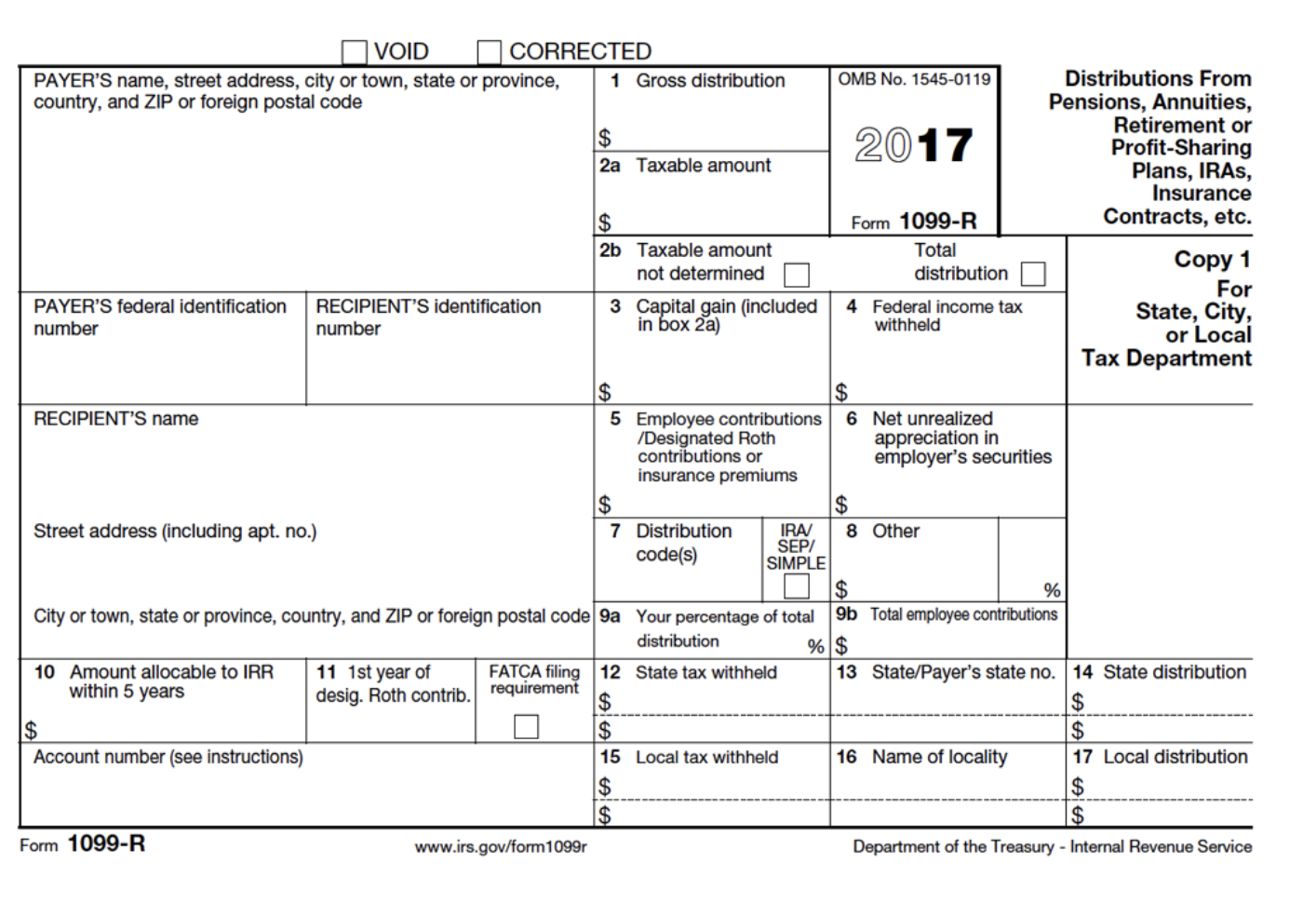

Maximize your cash settlement. Tha fact you received Form1099-R from your insurance company means that your insurance policy wasnt. A life insurance surrender is a full cancellation of a life insurance policy usually for the cash surrender value.

Average 4X cash surrender value. A charge levied against an investor for the early withdrawal of funds from an insurance or annuity contract or for the cancellation of the agreement. A life insurance policy is a long term contract.

Overall Tax Liability Life Settlement Amount minus Total Amount Paid Into Policy.

How Surrender Value Of A Life Insurance Policy Is Calculated Mint

The Real Story Behind Annuities Annuity Real Stories Stock Portfolio

Life Insurance Policy Loans Tax Rules And Risks

How The Cash Value Of Life Insurance Works Thrivent

Why You Should Be Careful With Life Insurance Policy Loans Forbes Advisor

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Life Insurance Policy Loans Tax Rules And Risks

1099 R Life Insurance Surrender Life Settlement Advisors

Life Insurance Laws By State Fidelity Life

Tax On Surrender Value Of Life Insurance Policy Life Settlement Advisors

What Happens When You Surrender A Life Insurance Policy Life Settlement Advisors

How To Calculate The Cash Surrender Value Of Life Insurance Life Settlement Advisors

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

How To Reinstate A Life Insurance Policy That You Stopped Paying Forbes Advisor

Can Life Insurance Be Cashed In Before Death Life Ant

2021 Guide To Permanent Life Insurance Types Costs Pros Cons Faqs